Self-employed

You can receive compensation from Barsel.dk, when going on maternity/paternity leave as a self-employed person or a private entrepreneur.

Compensation

See if you can receive compensation from Barsel.dk.

Who can get compensation?

You can get compensation if you meet one of these three conditions:

Upon birth

the child is born on 1 January 2021 or after

you get maternity/paternity benefits as a self-employed person or private entrepreneur from Udbetaling Danmark – Public Benefits Administration

you have an annual income from self-employment that is higher than the maximum unemployment benefit (DKK 264,420 in 2026).

Upon adoption

the child is adopted on 1 January 2021 or after

you get maternity/paternity benefits as a self-employed person or private entrepreneur from Udbetaling Danmark – Public Benefits Administration

you have an annual income from self-employment that is higher than the maximum unemployment benefit (DKK 264,420 in 2026).

How much can you receive?

You can receive up to DKK 240.35 per hour in total:

| Maternity/paternity benefits - Udbetaling Danmark | Compensation - Barsel.dk |

|---|---|

| Up to DKK 137.43 (2026 rate) | Up to DKK 102.92 (as of 5 January 2026) |

Your annual income has an impact on how much you can get in compensation from Barsel.dk. Your annual income must be higher than the highest unemployment benefit amount in order to get compensation from Barsel.dk (DKK 264,420 in 2026). It is Udbetaling Danmark – Public Benefits Administration that calculates your annual income, which is the determining factor in how much you can get in compensation. Udbetaling Danmark – Public Benefits Administration calculates your annual income, etc. on the basis of your tax assessment notice from the Danish Tax Agency.

Contact Udbetaling Danmark - Public Benefits Administration

Examples: Compensation per week

| Your annual income | DKK 264,420 | DKK 300,000 | DKK 400,000 | DKK 462,433 | DKK 550,000 |

|---|---|---|---|---|---|

| Maternity/paternity benefits from Udbetaling Danmark – Public Benefits Administration per week (2026) | DKK 5,085 | DKK 5,085 | DKK 5,085 | DKK 5,085 | DKK 5,085 |

| Compensation from Barsel.dk per week (as of 5 January 2026) | DKK 0 | DKK 684 | DKK 2,607 | DKK 3,808 | DKK 3,808 |

Even if your profit is higher than DKK 462,433 you cannot get more than the maximum amount of DKK 3,808 per week (as of 5 January 2026).

Period of compensation

Below you can see which weeks of your maternity/paternity leave you can get compensation for from Barsel.dk. You can get maternity/paternity benefits from Udbetaling Danmark – Public Benefits Administration for more weeks than you can get compensation from Barsel.dk.

Note that the weeks are distributed differently depending on whether the child was born/received (in the event of adoption) before or after 1 January 2024.

Upon birth

Upon adoption

How to share the weeks

If you as parents want to share the weeks between you, the compensation is divided between the self-employed and the other parent’s employer, regardless of which maternity/paternity leave scheme they are affiliated with.

The compensation is distributed based on when the mother and father/co-mother take the maternity/paternity leave. For example, if the mother is self-employed and takes maternity leave for the first 12 weeks, after which the father/co-mother takes maternity leave for 12 weeks, the mother and the father/co-mother’s employer will both be entitled to compensation for 12 weeks.

Example of distribution

Also note that the weeks are distributed differently depending on whether the child was born/received (in the event of adoption) before or after 1 January 2024.

Other questions

Apply for compensation

When applying for maternity/paternity benefits from Udbetaling Danmark – Public Benefits Administration via NemRefusion, you will also automatically apply for compensation from Barsel.dk. Therefore, you do not need to take further action to apply for compensation from Barsel.dk.

Payment of contributions

The financing of Barsel.dk s is from a fixed contribution that must be paid once per year.

You are obliged to pay contributions to Barsel.dk as a self-employed person or private entrepreneur even though you are not going on maternity/paternity leave and therefore not able to use Barsel.dk.

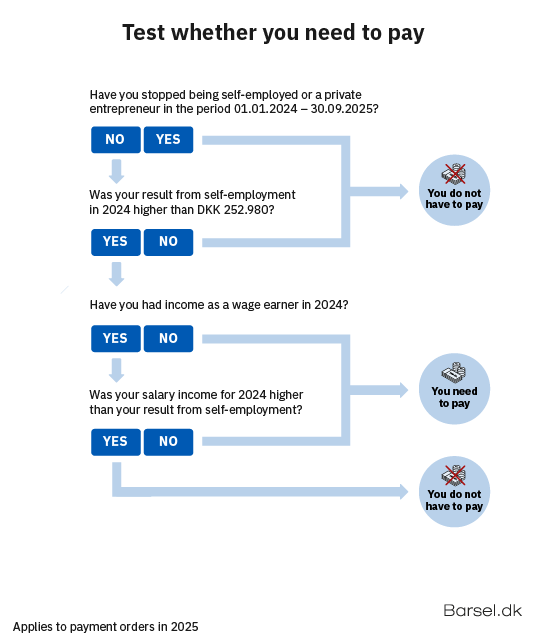

Answer the questions below and see whether you need to pay:

You will receive a collection order once a year

You will receive a collection order from Barsel.dk in your personal digital inbox in October if you need to pay contributions. You therefore do not need to take any action yourself until you receive the collection order.

Subsequently, you will receive a collection order once per year.

How much do you need to pay?

The contribution rate is DKK 2,200 per year (2026 rate).

| Year | Amount | See rules regarding the annual contribution rate on retsinformation.dk |

|---|---|---|

| 2026 | DKK 2,200 | Lov nr. 1625 af 16.12.2025 |

| 2025 | DKK 1,550 | Lov nr. 1457 af 10.12.2024 |

| 2022-2024 | DKK 1,350 | Lov nr. 2586 af 28.12.2021 |

| 2021 | DKK 1,225 | Lov nr. 2198 af 29.12.2020 |

Each year prior to the collection order being sent out, Barsel.dk will assess whether you need to pay contributions based on your annual tax assessment notice. It is the result on your annual tax assessment notice for the most recent concluded income year as a self-employed person or private entrepreneur that serves as the basis for the assessment. If Barsel.dk assesses that you need to pay, you will receive a collection order in October when Barsel.dk has received your annual tax assessment notice from the Danish Tax Agency.

If you need to pay contributions, this does not mean that you are entitled to receive compensation from Barsel.dk.

See here if you can receive compensation

The contribution from self-employed people or private entrepreneurs is the same as what employers pay to Barsel.dk for their full-time employees.

Repayment

Do you need to pay back compensation you have received from Barsel.dk? This is because Barsel.dk has recalculated your compensation on the basis of new information.

Barsel.dk pays you compensation on the basis of the information available at the time of processing the payment. It can therefore happen that Barsel.dk receives new information at a later date concerning:

that the entirety or part of your previously received compensation should have been paid to your employer

that your hourly rates have been adjusted

that part of or the entirety of your previously received compensation should have been paid to the other parent (as self-employed) or to the other parent’s employer.

The information is from Udbetaling Danmark – Public Benefits Administration which calculates your annual income, and this is the determining factor in how much you can get in compensation.

Reasons for why you need to repay money

Here you can see the types of situations that may result in you having to pay back compensation you have received.

Grief leave

If you have lost a child, you may be entitled to a payment from Barsel.dk, while you are on grief leave.

Grief leave is for when:

The child is stillborn.

The child dies or is given up for adoption before the 32nd week after birth.

An adopted child dies before the 32nd week after receiving the child.

How long you can receive payment depends on how much maternity/paternity leave you or potentially any other parent of the child has previously taken.

This means that if you or the other parent managed to take maternity/paternity leave, these weeks will be deducted from the total number of weeks you can receive during the grief leave.

Please note that the weeks are distributed differently depending on the loss or adoption of the child or after 1 January 2024.

Legislation etc.

Here you can find legal guidance relevant to Barsel.dk and read about how we process your personal data.

Legal guidance

How Barsel.dk processes your personal data

In the following, you can learn more about what data Barsel.dk processes, how we process the data and your rights in that connection.